Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys:

- Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves

- If it doesn’t buy another currency, it merely tightens monetary conditions in China

- If it does, it will drive up the price of whatever it buys, but crash it when it sells later

- It is still supporting the dollar, as the euro is (like the yuan) a dollar-derivative

- It would lose money by holding the positon, due to the interest rate in the euro

- It incurs severe exchange-rate risk (the euro is in a downtrend against the dollar)

- And the debt of Spain, Italy, and others is headed for a train-wreck

We promised to show, in this Part II, that China (or anyone else, including the mythological bond vigilante, unicorn, and dragon) cannot affect the dollar interest rate. This is a bold statement. So let is discuss.

Interest in the Gold Standard

Let’s start by reviewing the fundamental choice presented by a free market in money and credit, i.e. a gold standard. Prices are measured in terms of gold. Debt is denominated in terms of gold. We emphasize these two facts because the following conclusion may not be obvious in today’s casino markets. In the gold standard, the gold coin is the risk-free asset. Obviously, gold has no default risk. And in the gold standard, perhaps less obviously, it has no price risk either.

The bond must compete against the coin. It must offer a return to compensate the bondholder for not only the risk of default but also the loss of liquidity. A 10-year bond ties up money for 10 years. If you need your money in the meantime, you would not be entitled to redeem the bond. Redemption is a contractual obligation by the issuer to pay when due—on pain of bankruptcy, foreclosure, and liquidation.

You can sell the bond, of course, but a buyer in the market does not have the above obligation. His bid may be lower, when you need to sell. Perhaps much lower.

Viewed in this light, we see the interest rate as the price you are paid to take on both risk of default as well as risk of needing liquidity during poor market conditions.

Interest is a spread. It is the spread between the gold coin and the gold bond. It is the spread between their respective yields. The gold coin, of course, has zero yield. The bond has a positive yield. The spread between the two is important. It is time preference plus trust plus perhaps other factors.

This spread reflects two things. One, there is a real difference between holding a gold coin and holding someone’s promise to pay you a gold coin in the future. Two, you have a real choice. You can own the gold coin, if you wish. There is no downside, such as price risk. You don’t have to trade it for the bond, but you may at your sole discretion. This was a fact that every bond issuer once firmly grasped.

The Crime of ‘33

In 1933, President Roosevelt took away this choice. His diktat was not primarily a loot grab (though we assume that it pleased him to loot the gold owners). He fundamentally transformed the monetary system. Deprived of the gold coin, what was the most conservative saver supposed to own?

You may have heard the Treasury bond referred to as the risk-free asset. This does not describe its risk (of which, it is not free!) It describes its role. It is the ersatz gold coin, it is the surrogate conservative monetary holding. It has no price risk (for short term bills), and it has no default risk—other than the risk of the entire monetary system collapsing.

Roosevelt forced us to use Treasury paper as if it were gold. Everyone focuses on the fact that it loses purchasing power over long periods of time (we have written a lot about that). Much more subtle is that it disenfranchises savers.

There is no real difference—in this context—between holding a Treasury bill and holding a Federal Reserve Note (FRN). They are, in essence, the same thing! We will get back to the choice below.

The Treasury bond is payable in FRNs. And the FRN is backed by Treasury bonds. More precisely, the Fed issues its own credit—the FRN—to extend credit to the government and the banking system.

So what real choice is there? Whichever instrument you own, you still have exposure to the banking system. You have been deprived of any means of opting out. In the gold standard, you sold the bond to get the coin, when you did not want credit exposure. And it was not Boolean, all-or-nothing. Everyone holds a portion of their assets for safety, as opposed to return. The gold coin was that safe asset.

The FRN is not gold.

It is the fire that one can jump into if one does not like being in the frying pan Treasury bond. We say again: no real choice.

Of course, there is one key difference. The Treasury bond pays interest.

The Risk Free Asset

Roosevelt’s plan was genius—evil genius. The most conservative savers hand their wealth to the government. Everyone calls it lending, but it is never to be paid back.

We observed that, in gold, the interest rate was a spread between two things that are really different. The coin pays no yield. The bond does, but it is fundamentally different than the gold coin in that it carries credit and liquidity risk.

In our irredeemable monetary system, what is the interest rate a spread between?

The FRN is backed by the Treasury, which is payable in FRNs. They are both government paper. Both incur the same systemic credit risk, as well as the risk of debasement. And both have the same price risk. You don’t know, should you need to sell, whether the bid will be 200 milligrams gold, 20mg, 2mg, or maybe 0.002mg.

And this is a mirror image of the risk of holding a gold coin today. Yes, there are plenty of gold coins. Yes, it’s legal to own gold. But it is hard to justify owning gold because there is a risk that its price will go down, relative to your living expenses. And relative to your debt service payment.

Roosevelt created unnecessary and unnatural volatility.

Interest Is a Spread

But back to the spread. It is a spread between the Fed’s liability and its asset. Its liability is backed by its asset, which is payable in terms of its liability. It’s a little scheme between Treasury and Fed (to leave out any judgmental words). The spread between these two different colored bits of paper is undefined, arbitrary, and meaningless (the mathematical equivalent of attempting to divide by zero).

The interest rate could be 20%, it could be 1%, or it could even be negative. It is unhinged, and subjected to chaotic forces that push it this way and that (mostly that, i.e. down, since 1981). And it has been all of the above. Keith has written a theory about those forces.

Suffice to say here that the disenfranchised saver is not capable of being a bond vigilante. It is not for lack of desire, but lack of means. No matter how you trade one colored paper for the other—keeping in mind that the other is used to prop up the one—you are no bond vigilante. For a real world experiment, try this: get out of your chair, stand up, bend over, and pull up on your boot straps. Let us know when you achieve lift off, and we will write about the gravity vigilante!

Readers may be wondering what this has to do with China, and our statement that China (or anyone else) cannot affect the interest rate even if they wanted to. We feel that the above is a lot to digest. There are profound implications to these ideas.

Next week, in Part III, we will explore one of them: that China cannot affect the interest rate.

Supply and Demand Fundamentals

Monday was Memorial Day holiday in America.

The price of gold rose 8 bucks, and silver 16 cents.

With Keith being on travel, in Asia right now, this will be a brief Report. But speaking of Asia, everyone seems to be talking about China’s (and other countries, such as Russia) accumulation of gold.

We are not privy to the top-level discussions inside these governments, which are top secret and therefore anyone who is privy is not at liberty to write about it. But we can make a few observations.

First, whatever their intentions accumulation of gold reserves is not sufficient to launch a gold standard. This confuses cause and effect. It is like looking at a wet street, then upon seeing the rain one thinks “wet street causes rain.” This is the example, by the way, given by Michael Crichton who coined the term Gell-Mann Amnesia Effect.

No amount of gold reserves can push a gold standard into the world as it exists today. It can only amount to a price-fixing scheme, where the government stands ready to buy or sell gold at its official price. When the market decides it wants the gold, it will buy relentlessly until the central bank runs out of gold and abandons the peg, or they can abandon the peg earlier.

A gold standard arises by the decisions of millions or people to extend credit in preference to hoarding gold. Reserves are accumulated, not because someone decides to buy X tons of gold, but because people willingly hand their gold over to the banks to get interest. Absent interest, even if there were reserves those would be drained away by litmitless redemption requests.

Everyone understands the case of banana republic trying to maintain the peg of its currency to the dollar. This involves selling its dollar reserves and buying its currency to take the other side of the trade. Well, when it runs out of dollars, its game is over.

But even in the other direction—when a central bank wants to keep its currency down—it doesn’t work. The Swiss National Bank demonstrated this in January 2015. All it had to do was issue more francs and buy more euros, which everyone believed could be done without limit. But that fateful January, it hit the limit. Or we should say hit the stop. The stop loss order.

The gold standard is the money of a free market. It will not come about as the next step in our centrally banked, centrally planned world. We may not be privy to the internal discussions of any central bank, but we can be sure that none of them mean to renounce their power and shut down. They are looking for whatever works. To the extent they understand that the present system will collapse (we would not bet on this), they want the next thing. They may even think that next thing will be a government-managed, centrally banked, centrally planned gold standard. But if so, we can say for certain: it will not work.

And we are skeptical they think this. We suspect they are buying gold for the same reason others buy gold—in the expect its price will go up. If the price of gold would go up 3% a year, then it will be a better asset to own than a 10-year Treasury bond, currently paying 2.3% (not including the capital gains that Treasurys are certain to deliver).

Anyways, let’s look at the supply and demand picture of gold. But, first, here is the chart of the prices of gold and silver.

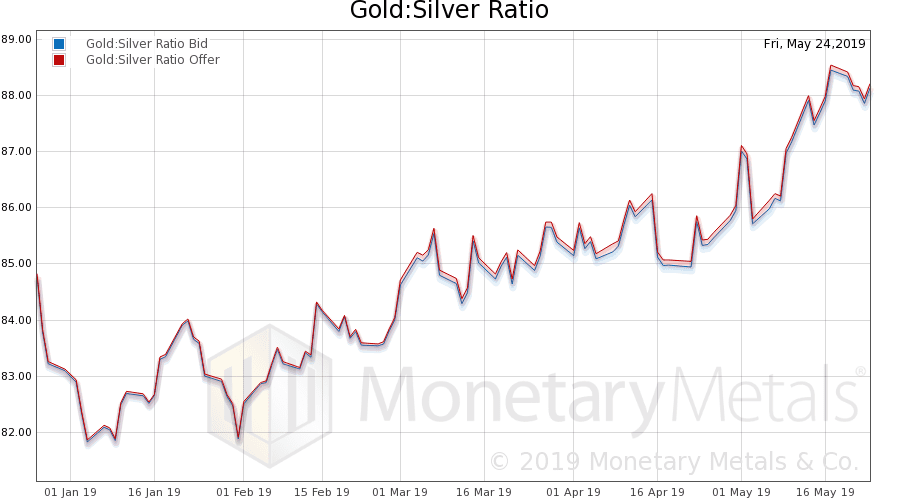

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio fell half a point.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

Note that we switched from the expiring June contract to the August.

There was not much change in the near contract basis, nor the gold basis continuous.

Nor the Monetary Metals Gold Fundamental Price, up two bucks to $1,372.

Now let’s look at silver.

In silver the basis move is choppier, but similarly ends close to even.

The Monetary Metals Silver Fundamental Price was down a penny, to $15.33.

© 2019 Monetary Metals

:

:

That’s a great FDR image–the pinky ring and cigarette holder say it all.

The question of whether central bankers would buy gold in anticipation of some resurgence of gold standard money is worth a very big extended study. They might have many plays in mind. The Fed books its gold at an artificially low price, so it may be a way to increase money supply without booking an equally large reserve asset. Russia is ostensibly preparing a gold-backed crypto offering.

RT featured a podcast from Renegade, Inc. with a socialist sales pitch for “MMT”. In addition to the usual Utopian snake oil, the proponent abused a key term from monetary theory. She is redefining a perfectly well-defined physics and economics property cited by the intro to the 1913 Federal Reserve Act: which is “to provide for the establishment of Federal reserve banks, to furnish an elastic,/em> currency, to afford means of rediscounting commercial paper, …” The physicist Young distinguished elastic from plastic deformation of a material by saying elastic effects are reversible in the way (say) a spring acts, where plastic deformation permanently stretches or otherwise deforms the material. An elastic currency supply grows and shrinks to match the seasonal and other cycles that naturally occur in any economy, especially an agrarian one like 1913 USA. Elastic currency would do this without losses to friction in the command and control of the “money supply”. MMT (in the deficit-may-care spirit of bringing the New Jerusalem to mother Earth) also requires deformation of the money supply, but it is a Plastic deformation that MMTers do not claim must be ever-reversible. Nonetheless, deficits without end, debt compounding to infinity and beyond are, in their theory, “elastic” — hence “modern” monies. To an MMTer, the purpose for having money is not to clear all commerce-in-progress, but to finance all Utopian programs. By not answering the important question of where excess money supply goes after that first spend by the government, I say that the MMTers leave us no choice but to think it will collect into great inert hoards of the 0.01%ers presumably to be wealth-taxed back so as to correct for the organic source of inequality they’ve introduced.

Talking about the 10 year bond, I recently read a report showing the remarkable correlation between Deutsche Bank’s share price and the yield on the 10 year German Bund (https://pbs.twimg.com/media/D7uOqDBXsAAMLoW.jpg:large)

The author went on to say: The deflationary black hole that German bund yields are sinking into is what is ailing Germany’s Deutsche Bank and that very same black hole is pulling US Treasury yields lower.

I wanted to share this because ‘the correlation’ seems to provide real time proof of the gravity well of a black hole.