On January 13th, 2026, CME Group changed the methodology used to set minimum performance bond requirements for precious metals futures. Gold and silver contracts moved from fixed dollar performance bonds to percentage-of-notional margin requirements. While this change may appear technical, its implications are structural.

As prices rise, the required margin collateral now rises automatically, materially increasing the cost of hedging for physical gold and silver businesses such as jewelers, fabricators, and other precious metals businesses.

Note: CME publishes current margin schedules in detail, but fixed dollar amounts vary by contract month and risk category. The figures used below are representative, drawn from recent CME notices and reporting, and are intended for illustrative analysis.

What changed in CME’s margin framework

From fixed dollars to percentages of notional

Effective January 13th, 2026, CME replaced fixed dollar margin requirements for precious metals futures with percentage-of-notional requirements:

- Gold futures: 5% of notional value

- Silver futures: 9% of notional value

Under the prior system, performance bonds were usually set as static dollar amounts per contract. While CME periodically adjusted those figures, the margin requirement itself did not mechanically scale with price. Under the new framework, it does.

Why this matters for physical metal businesses

For businesses such as jewelers, refiners, fabricators, and industrial users that use gold and silver as part of their business—margin requires working capital that must be posted, financed, and maintained.

When margins scale automatically with price, hedging becomes progressively more capital-intensive precisely when metal prices are highest and inventories are most valuable.

By contrast, leasing metal does not rely on futures hedging and does not require posting margin collateral.

Margin requirements before and after the change

To understand the economic impact, it is useful to translate the old, fixed margins into percentage terms and compare them with the new regime at current price levels.

Percentage equivalents at current prices (for context)

Assuming a spot price of $4,600 per ounce for gold and $90 per ounce for silver, levels observed in recent market trading:

Gold (pre-change)

- Notional value: 100 oz × $4,600 = $460,000

- $24,000 fixed margin ≈ 5.2% of notional

Silver (pre-change)

- Notional value: 5,000 oz × $90 = $450,000

- $32,500 fixed margin ≈ 7.2% of notional

New percentage margins versus old, fixed levels

Gold

- New: 5% of notional → $23,000 per contract at $4,600/oz

- Prior: ~$24,000 fixed

At current prices, the new margin is roughly comparable. The difference is structural: under the percentage regime, margin requirements increase automatically as gold prices rise.

Silver

- New: 9% of notional → $40,500 per contract at $90/oz

- Prior: ~$32,500 fixed

This represents both a meaningful immediate increase and a margin requirement that escalates mechanically with price.

Illustrative percentage change

- Silver margins rise from roughly 7.2% of notional to 9%, a relative increase of approximately 25% at current prices.

- Gold margins may appear similar today, but under a percentage system they ratchet higher as prices rise, whereas fixed-dollar margins would not.

Impact on hedging costs for physical inventory holders

Under a percentage-of-notional framework, hedging costs scale directly with price. For physical gold businesses—such as jewelry manufacturers holding metal inventory—this creates a growing balance sheet burden tied to price appreciation, not to any change in operations.

More capital must be posted as margin even if the business’s amount of physical exposure is unchanged.

“When you hedge your gold exposure, rising margin requirements can make your window suddenly half empty,” said Gökhan Yılmaz, CEO of AgaOne and client of Monetary Metals. “You can be forced to sell a large portion of your jewelry inventory—not because demand fell or operations changed, but simply to meet higher margin requirements.”

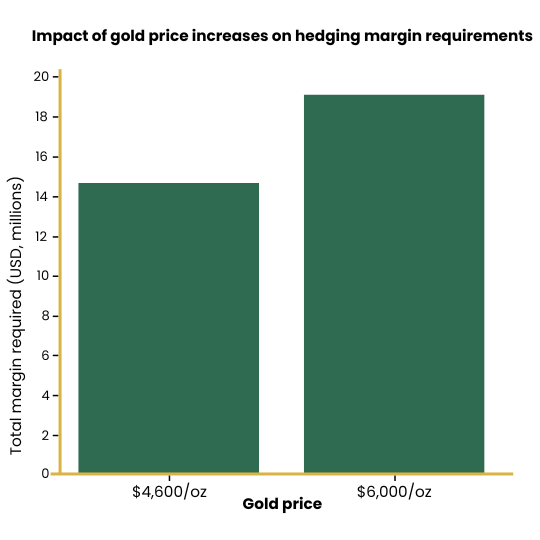

Example: hedging two metric tons of gold inventory

Consider a jewelry manufacturer holding two metric tons of gold.

- Two metric tons ≈ 64,000 ounces

- COMEX contract size: 100 ounces

- Contracts required: 640

At $4,600 per ounce

- Notional per contract: $460,000

- Margin per contract (5%): $23,000

- Total margin required: $14.72 million

At $6,000 per ounce

- Notional per contract: $600,000

- Margin per contract (5%): $30,000

- Total margin required: $19.2 million

Capital and financing implications

To hedge the same physical inventory, required margin collateral rises by more than $4.4 million as gold increases from $4,600 to $6,000 per ounce.

That implies roughly $270,000 per year in incremental financing cost (assuming borrowing costs of 6% per annum). The cost increases though nothing about the jewelry business itself has changed. The firm did not increase inventory, expand production, or grow sales—the gold price simply rose, entirely outside of its control.

Yet it must now commit additional capital solely to maintain an existing hedge, a use of scarce balance sheet resources that produces no incremental output, revenue, or operational capacity.

Leasing versus hedging

There is an alternative available to the industry – metal leases. Physical metal leasing avoids futures markets entirely, providing the business with the amount of metal it needs at a simple annual rate.

No futures positions means no margin requirements and no margin calls.

Leasing and futures hedging are not identical tools, and leasing involves its own considerations such as lease rates, tenor, and counterparty exposure.

However, for many inventory holders, leasing can materially reduce the amount of capital tied up purely to support hedge mechanics.

For jewelers and other inventory holders, a lease, like the ones we offer at Monetary Metals, converts what would otherwise be trapped, unproductive capital into productive working capital.

Strategic implications for the precious metals industry

Percentage-based margins accelerate the capital demands on precious metals businesses as metal prices rise. The higher the price of gold or silver, the larger the share of balance sheet resources consumed by hedge collateral. In today’s business environment, capital efficiency and allocation are a decisive competitive factor.

By leasing through Monetary Metals, businesses can improve their capital structure, without sacrificing operational integrity or performance, and gain a competitive edge in their industry.

:

: