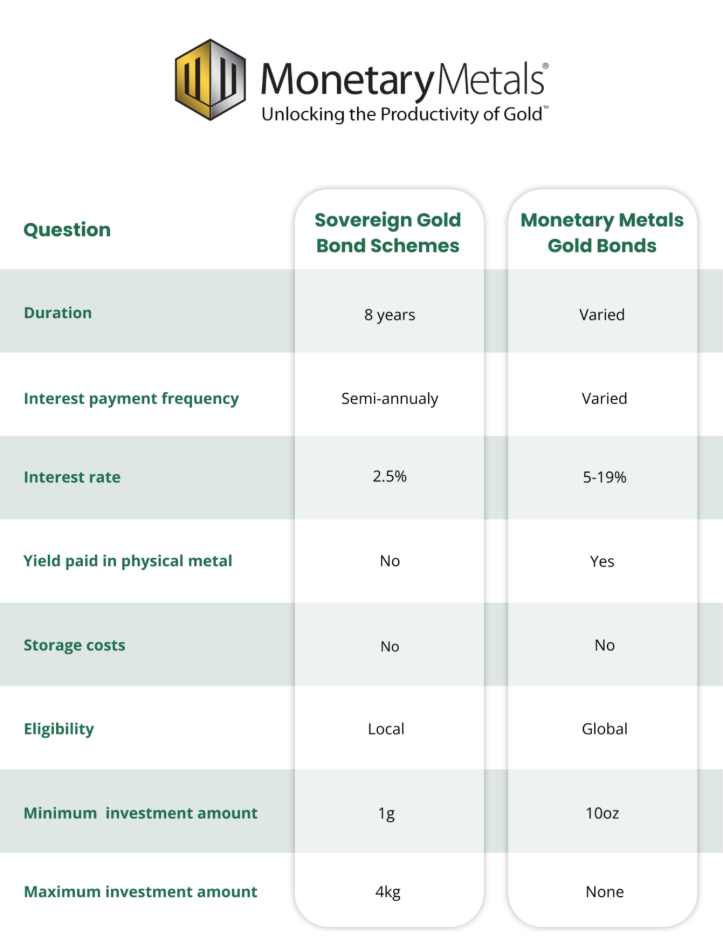

In this article, we compare government-issued sovereign gold bond programs with privately issued gold bonds from Monetary Metals.

First, we examine what sovereign gold bonds offer and why India’s once-popular scheme was ultimately discontinued.

Then, we’ll look at how Monetary Metals’ Gold Yield Marketplace™ provides a transparent, sustainable way for investors to earn a Yield on Gold, Paid in Gold™.

Sovereign gold bond schemes

Several governments have launched gold-backed investment products, most notably India. In 2015, India introduced its Sovereign Gold Bond (SGB) scheme to reduce reliance on imported physical gold.

The goal was to discourage Indian citizens directly purchasing gold by offering an interest-bearing alternative and thereby limiting capital outflows.

While initially popular, the program was discontinued in 2024.

Why?

Because it failed to meaningfully reduce demand for imported gold, and since there was no real underlying financing happening, it lacked financial sustainability.

How the sovereign gold bonds worked

The Reserve Bank of India (RBI) issued SGBs, which were quoted in grams of gold and which offered fixed interest payments in cash. Investors were exposed to gold price movements while earning a small yield.

Key features of SGBs:

- Quoted in gold – Investors purchased bonds representing a fixed quantity of gold.

- Fixed interest rate – It paid a 2.5% annual interest rate, but it was denominated and paid in rupees rather than grams or ounces.

- Government guarantee – The principal and interest were backed by the Indian government.

- Cash redemption— Investors received the rupee equivalent of gold at maturity, not physical gold.

- Tax benefits— Capital gains tax exemptions were available for long-term holders.

Why sovereign gold bonds were discontinued

While these bonds did track the gold price and offered a fixed return, they had a fundamental flaw.

The government was not actually using gold productively to generate interest.

Instead, the 2.5% interest payments were funded by taxpayers.

In other words, the program wasn’t an investment; it was a subsidy!

Since the government did not deploy gold into productive ventures (such as leasing or lending to gold businesses), the scheme became expensive, inefficient, and unsustainable.

It ultimately failed to reduce gold imports in a meaningful way, leading to its discontinuation in 2024.

With SGBs no longer available, investors looking to earn a return on their gold must seek alternative options like gold leasing and private gold bonds.

Gold bonds from Monetary Metals

Monetary Metals takes a fundamentally different approach to gold bond offerings, solving many of the shortcomings of government-issued gold bonds.

Our gold bonds are structured to provide returns paid in physical gold, aligning the interests of gold investors and gold borrowers.

Here’s what sets gold bonds from Monetary Metals apart:

- Principal and interest are denominated in gold and paid in gold – Investors are paid their original investment and interest in ounces of gold, not fiat currency.

- Backed by real production – Borrowers use the proceeds for economic activity, such as mining or manufacturing.

- Market-driven rates—Interest rates are determined by supply and demand, reflecting the risk and return profile of each bond.

Why it matters

The key difference between sovereign gold bond schemes and gold bonds from private providers like Monetary Metals is how returns are generated.

Governments do not put gold to productive use. In India’s case, the interest payments on SGBs (2.5% annually) were funded by the government, rather than being derived from real returns on gold.

This lack of sustainability ultimately led to the scheme’s discontinuation.

Monetary Metals, by contrast, facilitates gold bonds backed by real economic activity.

Our Gold Yield Marketplace™ connects gold borrowers and gold lenders, with interest rates reflecting the risks and rewards of gold-based financing.

This means that gold bond structures can vary in duration, interest rates, and payment methods.

Since these returns are truly market-driven, there are ample opportunities to connect borrowers and lenders in win-win transactions.

Put your gold to work

For investors looking to earn a return on their gold that’s paid in more gold, Monetary Metals provides a transparent, sustainable alternative to government gold bond schemes.

Let’s have a discussion on how to put your gold to work.

:

: