The contradiction: cheering dollar gains

There’s a strange contradiction among many gold owners. They buy gold to escape or reduce their dollar exposure but then look to sell that gold when the price of gold rises in dollar terms. And they measure their success in the very unit they don’t trust.

When gold rises the temptation is to sell. After all, if the “value” of your holdings has gone up. Shouldn’t you “take profits”?

Pause for a moment. Why is the dollar price of gold rising? Has gold itself changed? No. The ounce you hold today is the same ounce you held yesterday. What has changed really is the value of the dollar. A higher gold price is not a testament to gold’s newfound strength, but proof of the dollar’s ongoing decline.

This underlying reality is not cause for celebration. It is a signal of financial decay. And the tragic irony is that it’s exactly in this moment, when the dollar’s weakness is being confirmed, that many gold owners are most tempted to sell their gold — exchanging it back into the very currency which is falling.

You bought gold because you don’t trust the value of the government’s money. Is that trust somehow regained when the gold price rises?

Historical lessons: It’s a trap!

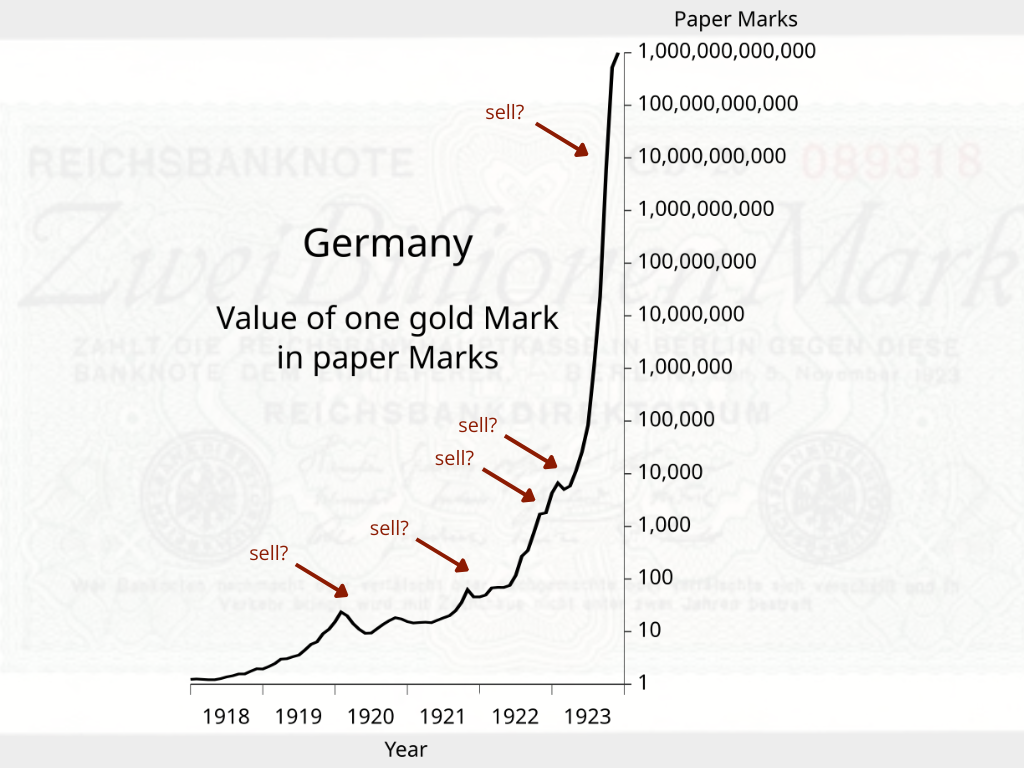

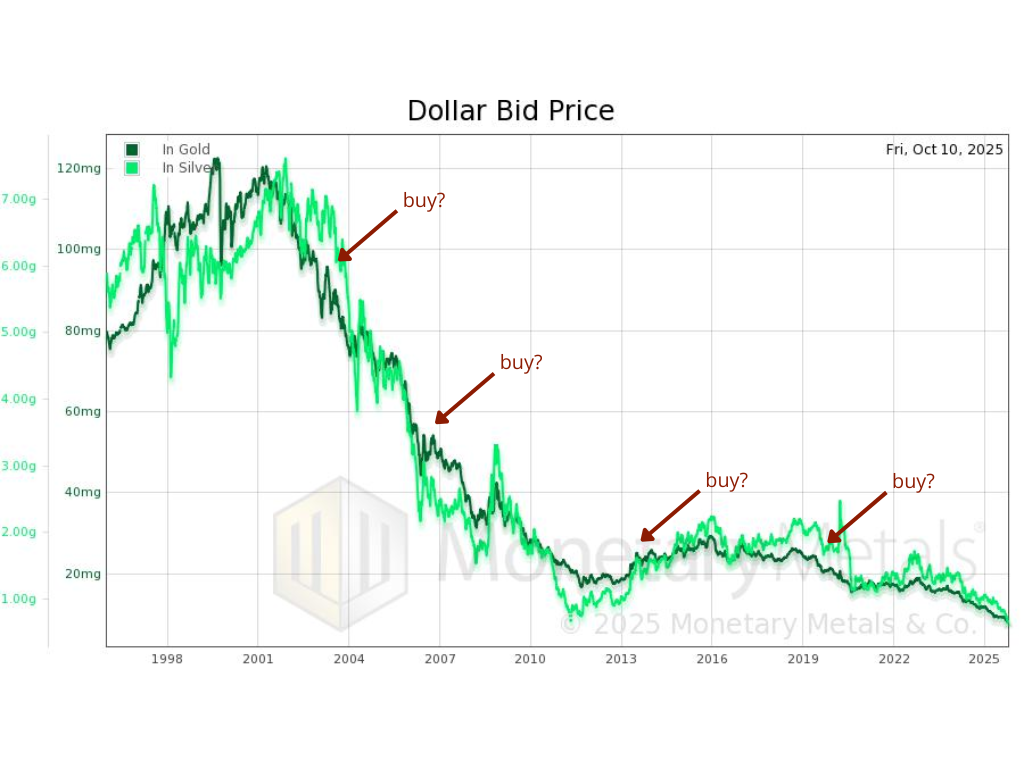

History can be an excellent guide. Consider the following two charts. At which point on these graphs should investors look to “sell” their gold? Or “buy” the dollar? (which is the same thing, ultimately).

Now consider the next chart. Why do we expect this one to end differently?

Alas, it’s not so simple as that, is it? You have to consume in order to live. And most people would rather spend dollars than gold (we would anyway).

The real-world constraint: dollar liquidity

It’s a practical reality. You can’t (generally) buy houses, groceries, or energy with gold. Everyone needs dollar liquidity at some level.

This is why many end up selling their gold. But the need to consume doesn’t erase the problem. Because every time you sell gold, your gold stack shrinks.

Even if you’re selling into a rising price environment, your overall ounces still decrease, just less than before. And it’s ounces, not dollars, that matter most in the long run.

Your gold is the foundation of your financial independence. Selling ounces to cover expenses is like a farmer selling land to pay bills. It works just fine to cover the bills, but now there’s less productive potential for his farmland. If the farmer continues, ultimately there will be nothing left.

It’s the exact same with gold: each sale erodes your foundation, leaving you with less gold.

How can gold owners manage the need for dollar liquidity without resorting to selling their gold?

Solution: Live off the gold income, not the principal

In the same way you can collect rental income on real estate, and spend that income without selling the property, so too can you collect rental income on your gold and sell the gold income to meet your liquidity needs, without having to sell the principal.

Monetary Metals’ clients put their gold to work and earn a yield denominated in ounces. Instead of your gold stack dwindling over time due to storage fees, or having to sell, your ounces actually grow over time. And they don’t just grow linearly. They grow exponentially, via the compounding effect. But the point here is that it’s not compound growth in dollars. It’s compound growth in ounces.

Earning income in gold eliminates the contradiction gold owners face. You don’t have to undermine your own thesis by selling your gold foundation for dollar liquidity. You can preserve and grow your wealth in gold, while still accessing spendable dollar resources when needed, through the gold income you earn.

And ideally, you spend less than you earn, so your gold stack grows over time, your earning power increases, and you and your family are materially better off (in ounces) than before.

This is the long-forgotten virtue of savings – spending less than you earn. It is a proven way to build wealth.

More than just a yield on gold

A Yield on Gold, Paid in Gold® is one of our mottos. It’s simple, direct, and describes, in no uncertain terms, what we deliver to our clients.

But it’s so much more than that. A yield on gold is a lifeboat off of a sinking ship. It’s a passport to a newer, better country. It’s a gift that keeps on giving. It’s a path toward greater financial security, stability, independence, and prosperity, for you and your family. And it’s a way to manage the daily needs of life while building real wealth in an asset that can’t get inflated, eroded, or centrally mismanaged away.

But of course, we couldn’t fit all of that into just seven words!

A permanent solution to a permanent problem

The dollar is broken. And as far as we can tell, it’s broken permanently, with no good solutions on the horizon. Buying gold to escape the dollar, only to sell it for more dollars later that are worth less is…how do we put it…not a solution. At best it offers some temporary protection.

There’s a better way.

Own gold. Lease it for income. And spend the income when needed, never the principal.

This is a permanent solution out of dollars, not a temporary one. This is Monetary Metals.

:

: