Last week, we made a very controversial statement. We are happy to write the truth, and let the chips fall where they may (e.g. our thoughtful disagreement with Ted Butler about price manipulation). We can accept the flak that we get for this, so long as our position is understood. Some criticized our approach as mere technical analysis, and therefore insufficient to the task of explaining the dynamics of the gold and silver markets. But whether we quibble with this characterization of our work or not, we believe that the points we made and the unique data we published stand. No one, including Mr. Butler, responded substantively to our data or logic. People can read and choose sides, and we’re OK with that.

But last week, we said something that we feel was not well understood. And it is one of the most important ideas in monetary economics, and the key to understanding banking.

The Federal Reserve, of course, is a key participant in this monetary inflation scheme. Does the Fed have a printing press? Does the Fed print?

Like any bank, the Fed borrows to fund its purchases of interest-paying assets. It earns a spread between what it pays (currently about 1.25%) and what its asset portfolio pays (over 2%)… Unlike any commercial bank, there is a law that obligates us to treat the Fed’s liabilities as if they were money.

Borrowing is pretty close to the opposite of printing. So how is it possible that there is so much contention on this issue? Perhaps it would be more accurate to say that, in Austrian circles, there is little contention: Monetary Metals are just heretics!

If the Fed printed, then hyperinflation would have come, and this is what many Austrians predicted. For example, one famous personality predicted at FreedomFest in July 2009, that we would have hyperinflation by the end of that year.

Printing would create a flood of worthless paper. Apart from the sheer quantity of it (trillions), would be the absurdity, the meaninglessness of it. Though many call the dollar “worthless paper”, it is not worthless. It is still quite worthful—a dollar can buy over 24 milligrams of gold, not to mention food, fuel, housing, artwork, and laptops on which we can pontificate about matters monetary.

But suppose an organized crime ring printed up $3,500,000,000,000, and went on a shopping spree. These forgers begin buy everything from cases of Cristal to paintings by Cézanne, from Maybach cars to Malibu homes. What would happen?

They would push up the prices of everything. Relentless buying by price-insensitive purchasers lifts all offers and keeps moving them up. Of course, if you have a printing press then it does not matter to you if Cristal is $200 or $20,000. You can easily print more. Price only matters to those who have to earn before they spend (or liquidate the family estate).

So the net result of printing would be relentlessly but probably steadily rising prices. At first. Until people begin to see the game and look forward to its inevitable denouement. Then something happens. Economist Ludwig von Mises described the “Crack Up Boom”:

But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against “real” goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

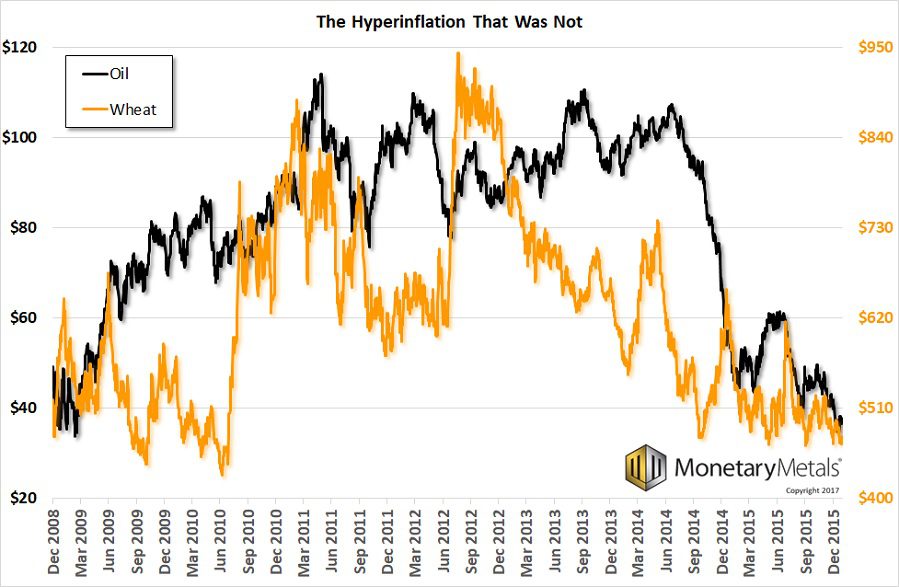

We must reckon with the fact that this did not happen. Here is a graph showing the prices of crude oil and wheat from the start of the first “quantitative easing” to the end of “zero interest rate policy”.

Both commodities go up, though wheat went down first. They end lower than they start. Notably, wheat (and other commodities) began to fall by late 2012. Oil was last to join the party (due, we believe, to geopolitical risks rather than monetary effects) in mid-2014.

We don’t want to quibble here. The question is not: “did oil go up proportionally to the increase in the quantity of dollars?” Oil went up about 133% from start to peak in April 2011, while M1 measure of money supply went up 20% during the same period. Then as M1 increased by an additional 63%, oil went sideways before declining 69% from its peak.

The question is: “what did the Fed do?” Obviously, it did not print and buy wheat or oil (nor give the dollars to someone else who did).

The Fed exchanged dollars for bonds (Treasury and mortgage). This leads to two questions. One, what is the nature of a dollar and of a bond? Two, what does it mean for the Fed to make such an exchange?

There is much confusion today because we call the dollar “money”. In the classical gold standard, the paper dollar was redeemable. That is, anyone could bring dollar bills to a bank and exchange them for gold coins. The bill, or note, is a credit instrument. It is paper evidencing an obligation to pay money on demand. The gold is the money.

Now that the dollar is irredeemable, there is a temptation to use shorthand and say that the dollar itself is money, to define money as just a medium of exchange. But if the dollar is money, what is the difference between the dollar and the bond? Both are forms of credit.

The difference is duration.

The dollar is a current asset, whereas the bond matures sometime in the future. It is interesting how much debate occurs over the question of how to define and measure the money supply. This debate occurs because everything in our monetary system is credit, and it’s hard to find a clear place to draw a line and say “this credit is money, but that credit is not money.” (One measure is called MZM—money of zero maturity.)

The dollar is the liability issued by the Fed. It issues this liability to fund its purchase of longer-duration credit assets. Why? As we said last week, the Fed earns the spread between the cost of issuing its liability and the yield it earns on its assets. This is what any bank does.

The issue of printing reminds us of those brain teaser paradoxes. Seven people go out to dinner at a restaurant, and the tab is $300. The first person puts in five tens, the second person puts in three twenties and takes a ten, etc. Somehow after the last person puts his dollars on the table, the pile of cash comes up short. Where did the money go? The key to understanding the paradox is that there is always a rhetorical sleight of hand.

It is the same with the key question of the fractional reserve debate: a bank takes in $1,000 and lends $2,000. Where did it get the money? The Fed buys a trillion worth of bonds, where did it get the money?

It is crucial to understand the nature of the dollar. It is not a positive value, an entity in existence. Like a lump of metal. A dollar is a relationship between two parties, one of owing. One party owes the other.

When the Fed issues a dollar, it is a debt owed to the recipient. The Fed is borrowing from the recipient. When the Fed buys a Treasury bond from someone with newly-issued dollars, that party is exchanging one kind of credit for another. It exchanges one debtor party (the US government) for another (the Fed). It is exchanging a longer-duration asset for a current asset. It is exchanging yield for liquidity.

Long-duration assets have duration risk. That is, the price varies inversely with the interest rate. The shorter the duration, the less the risk, and the dollar is the shortest with zero duration risk.

The Fed increases its balance sheet. That is, it has a new liability and a new asset. But it has no free “spending money”. It does not gain any equity in the bond-buying transaction.

The seller of the bond does not get free money, either. It exchanges one kind of credit paper for another. It likely does gain a small amount of equity, as the Fed is typically paying the offer price which is likely above what the seller paid for the bond originally.

We can look at the net result, and say it is printing and it is increasing the quantity of money. But that’s not useful, either as a description of what happened and certainly not as a predictor of what will happen next.

This is why we say the net result is that the Fed increases its balance sheet, the Fed takes on more duration risk, the Fed pushes interest rates down, and the seller gives up the yield it had. Most likely, the next step is for the bond seller to buy another asset, to invest and not hold cash.

There are two differences between the Fed and any commercial bank in a free market. We discussed one last week: the government forces us to treat the Fed’s credit as if it were money. Government schools and regulators strongly induce everyone to think in those terms.

The other is that the Fed is not a market actor, motivated to seek arbitrage opportunities to make a profit. It is a non-economic actor, imposing monetary policy to achieve political goals (based on rubbish economic theories).

A commercial bank could not buy bonds without limit. Its cost of credit would rise, while the yield it could obtain on bonds is falling. The compression of this spread is the signal to stop.

When a bank issues its credit paper to buy an asset, the seller is expressing a preference for the liquidity and lack of duration risk of a current asset. The bank is expressing a preference for assets that will earn it a yield. The seller gives up the yield, and the bank gives up some capacity for funding balance sheet expansion (i.e. takes on some liquidity risk).

It is counterintuitive to say it this way, but it’s vitally important to see the essence of it: the bank is borrowing from the seller of the bond. It is borrowing and buying, borrowing while buying. Borrowing to buy.

The above description should not be taken as a defense of the Fed, nor of the practice of duration mismatch by the banks. If we are to be monetary pathologists, we need to begin by correct observation. We must be able to look through a microscope at a slide of diseased tissue and saying “nope, it’s not cancer. It’s a different kind of tumor, and it will kill you in a different way.”

We live under an absurd monetary system. It is designed to sacrifice the savers—who don’t realize they are creditors—to the debtors. Savers cannot escape the credit pen, not even when they hold what they think of as money. They are disenfranchised. They can gnash their teeth as the interest rate falls to zero and beyond, but their protests are toothless. Meanwhile, debtors can borrow to repay principal when due.

Credit should be redeemable. And there is precisely one commodity which works better than all others for redemption. Indeed few others would even come close to working at all. Can you imagine crude oil? A week’s wages for the average person in America is about 850 gallons of oil. Would you like a driveway slick, a dead lawn, or do you have a big tank?

This is the argument for why we need the gold standard. The whole point of a Yield on Gold, Paid in Gold®, is to lead towards the gold standard. A yield on paper, paid in paper sure isn’t working any more.

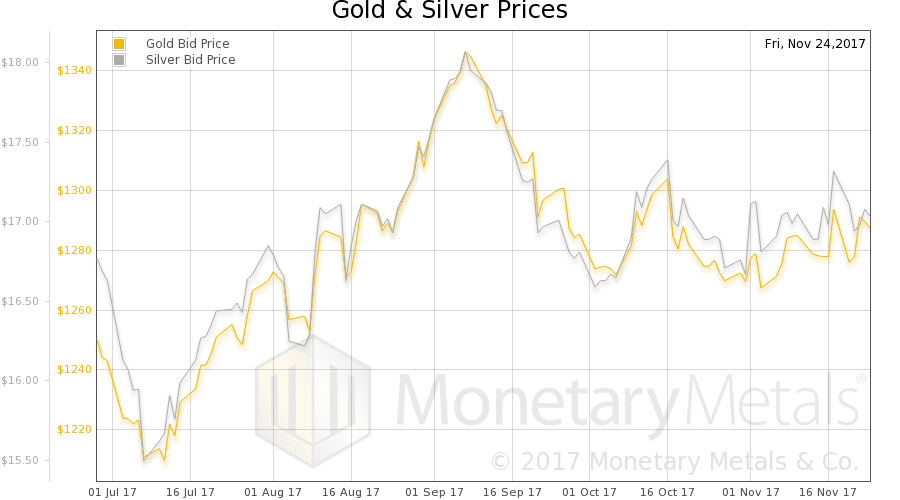

The price of gold fell $7, and that of silver 24 cents. This was a holiday shortened week, due to Thanksgiving on Thursday in the US (and likely thin trading and poor liquidity on Wednesday and Friday). So take the numbers this week, including the basis, with a grain of that once-monetary commodity, salt. We will keep the market action commentary brief.

Here are the charts of the prices of gold and silver, and the gold-silver ratio.

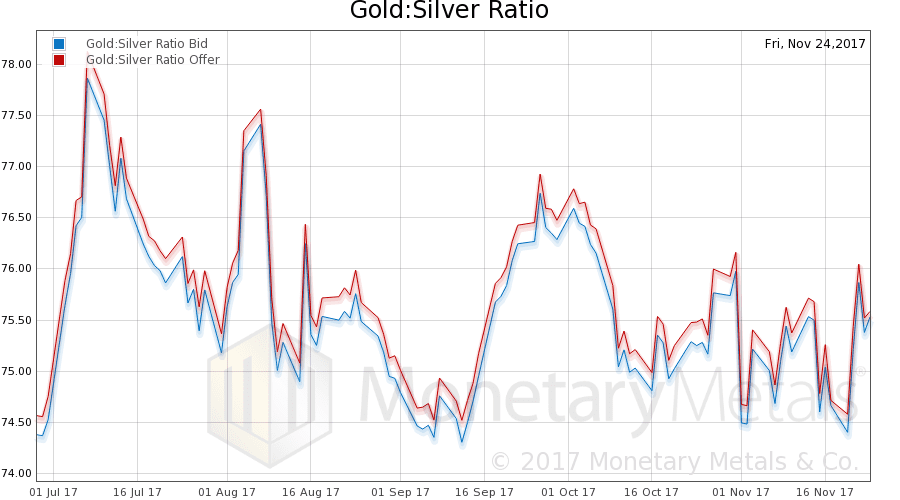

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

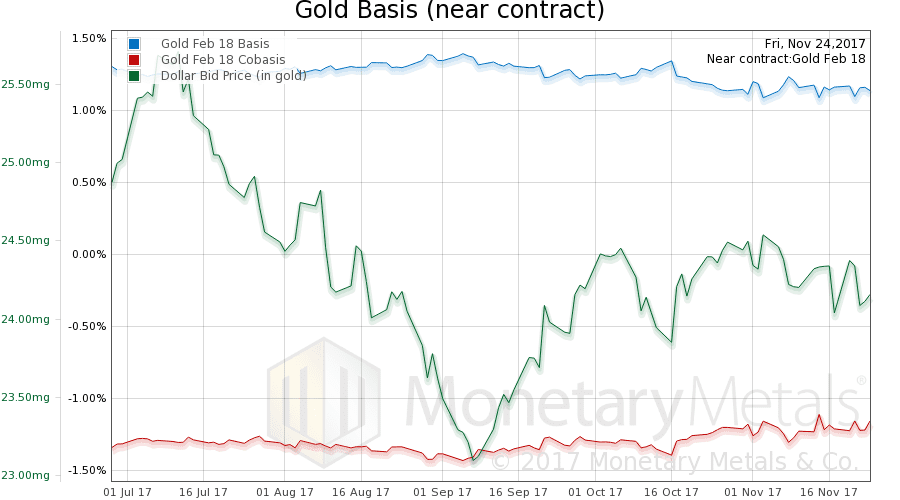

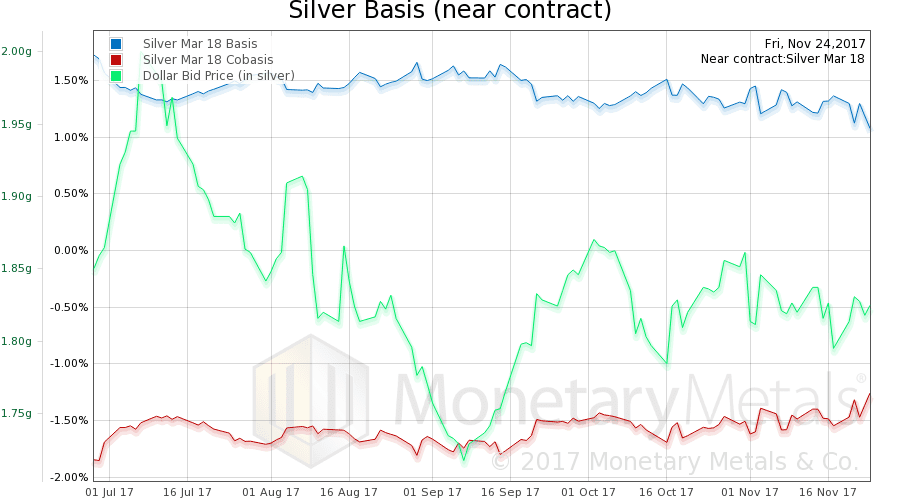

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph showing gold basis and cobasis with the price of the dollar in gold terms.

The cobasis (our measure of scarcity) of the Feb contract rose slightly, as the price of gold fell slightly.

The Monetary Metals Gold Fundamental Price is up 8 bucks.

Now let’s look at silver.

The story is the same in silver, with a bit larger rise in the cobasis.

The Monetary Metals Silver Fundamental Price is up 22 cents.

© 2017 Monetary Metals

:

:

Another very informative article. Thanks so much, Keith.

“The Fed increases its balance sheet. That is, it has a new liability and a new asset. But it has no free “spending money”. It does not gain any equity in the bond-buying transaction.”

All true, strictly speaking, but I don’t think this formulation captures the economic effect. The Fed’s “new liability” is the result of an accounting convention, not a reflection of reality. It can issue both notes and reserves at will and without meaningful cost, and the decision to pay IOER is born of a desire to control how banks deal with reserves rather than representing borrowing costs.

The inflationary effect of QE, as of course you know, has been mostly visible in asset prices. Still, without the various extraordinary Fed (and other central bank) efforts, I don’t doubt the world would have plunged into a severe deflationary depression in the wake of the crisis. So, it has had an “inflationary” effect but it’s been muted by the underlying deflationary forces generated by widespread overindebtedness and the “China effect”.

So long as people remain confident “the authorities” broadly know what they’re doing and have things under control, they will also be willing to hold the abnormal quantities of cash stemming from QE without arking up too badly. If serious inflation is going to arrive, I think it will only be when that confidence is finally shaken. Perhaps, at a guess, when the authorities take even more extreme measures post the next leg of this (slowly) unfolding crisis.

I really can not wrap my head around borrowing to buy. I don’t borrow to buy a bond…I save to buy a bond. The issuer of the bond is borrowing from me. The tricky question you posed is “The Fed buys a trillion dollars worth of bonds, where did it get the money?”

Where indeed? I thought is just created the money electronically. also called printing. But you say no. So I don’t get where it “borrowed the money” to buy the trillion in bonds.

Let’s simplify a bit more.

Borrowing is acquiring something now that must, in some form or another, be paid for in the future. In the past, this worked through economic growth, and we are so used to this we cannot imagine any other outcome now.

The perfect monetary motion machine…borrow, borrow, and borrow some more.

The point now is, we’ve borrowed so much, there are no real resources left. Huge amounts of real capital – mainly fossil fuels, but really any mined commodity you can think of, that would have taken centuries to develop have been used up. All the resources of the world are collateralized to meet present debt obligations. So not only will we get hyperinflation at some point, but after that there will be no return to borrowing….EVER. We will return to a permanent dark ages of bartering and local money systems in which people maybe borrow for six months to a year, and that’s it. There will be no escape from this dark age for millions of years, maybe longer.

Just think about it and ask yourself whether I’m right or wrong. That’s all.