Sometimes, one just needs to look in the right place. And often in those cases, it just takes a conversation to alert one where to look. We had a call with a Swiss company this week, to discuss gold financing for their business. They reminded us that there is a negative interest rate on Swiss francs. And then they said that a swap of francs for gold has a cost. That is, the CHF GOFO rate is negative (the dollar based 12-month MM GOFO™ is +2.4%).

Banks and the Gold Forward Rate

Let’s review what GOFO means. The London Bullion Market Association described it:

“[the] rate at which contributors were prepared to lend gold to each other on a swap basis against US dollars.”

In other words, the bank gives you gold and gets dollars in exchange. This is not a sale, but a swap, which means that the gold and dollars return to their original owners at maturity. Here are the steps in the mechanics:

- You give dollars to the bank

- The bank gives you gold

- Wait 1, 2, 3, 6, or 12 months

- You give gold back to the bank

- The bank returns your dollars, net of the swap rate

What is the bank doing? The bank buys gold, and simultaneously sells a forward. Neither you nor the bank have any exposure to the price of gold. The bank is carrying gold, not to put it in the warehouse but to swap it to you. Presumably you do something productive with the gold.

A Positive GOFO

Incidentally, this is why all analysis of futures contracts divided by gold in the COMEX warehouses is flawed. It does not count the gold on swap. This gold is in inventory at jewelers, refiners, mints, and other gold-using businesses. It is not in the warehouse, and not counted in eligible or registered inventory. At any rate (if we couldn’t commit the occasional pun, this economics stuff would get boring) MM GOFO is positive. If you entered into a gold swap on Friday, you would give a bank say $11,900,000 and get 10,000oz of gold. At the end of the year, you would return the same 10,000oz but you would get around $12,185,000. The extra $285,000 dollars come from the positive gold forward rate. Why is the gold forward rate positive? Because gold is in contango. Contango is when the price of gold for future delivery is higher than the price for immediate delivery (spot). One can buy spot, sell a future, and make a profit. This is the gold basis, the pretty pictures we show every week in our Report.

The US Dollar vs the Swiss Franc

The gold basis is positive in US dollars, but not in Swiss francs. The first question is: Why not. The second question is: What does it mean? The Swiss franc has a negative interest rate. That means the Swiss commercial banks must pay to park reserves at the Swiss National Bank. The commercial banks don’t necessarily charge small retail depositors. But corporations and institutions generally pay interest to the banks. This is very perverse. Think of this as a cost to store francs. And what else has a storage cost? Gold. Gold is normally a contango market, because the warehouseman is not willing to sell a futures contract without covering the cost of storage. The franc is a contango market, for the same reason. As an important aside, it must be noted that currency is not “stored”. It is lent. If the lender gets a negative return, that’s a signal that the borrower has no good use for it. A question outside the scope of this article is: what can happen to a whole economy that no borrower has a good use for currency.

Gold, Free Lunch, and Francs

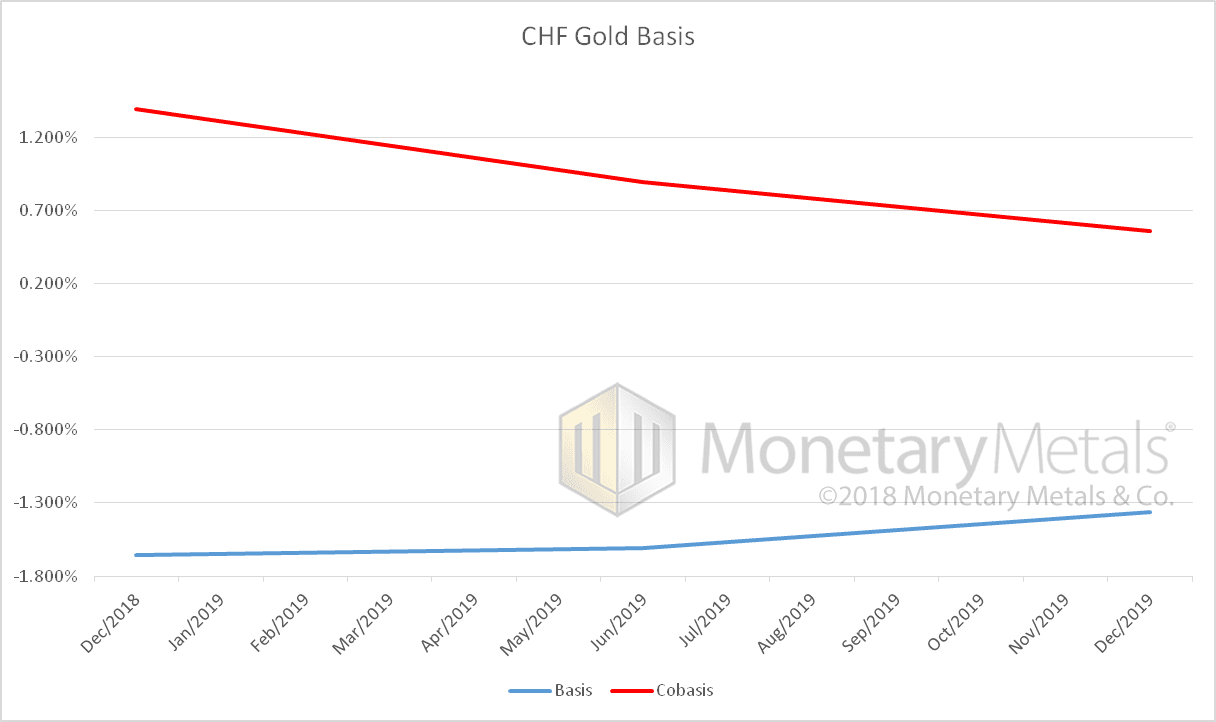

Anyways back to the topic. If you need gold in one year’s time, you can either pay to store it, or you can pay the warehouseman to store it for you. Sorry, the market does not offer a free lunch (thanks to arbitrage). It’s the same with francs. So this week, we pulled up some numbers to put this in perspective. At a time when the franc in the spot market was $1.0211 (offer), the Dec franc futures contract was $1.028(bid). Basis = Future(bid) – Spot(offer). The 3-month franc basis is around 2.6% annualized. This contango goes all the way out. For example, the December 2019 franc is $1.062(bid). We do not have real-time bid and ask prices for gold quoted in CHF. However, we can calculate the transactions to sell francs to buy dollars to buy gold. This gives an indication of the gold basis in CHF. If anything, a direct trade of francs for gold would have a tighter spread than our separate transactions. A tighter spread would mean a higher basis and higher cobasis. That is, greater backwardation. We did some rough, back-of-the-Excel math. Here is a graph of the gold basis in CHF.  The cobasis for Dec 2019 is +0.56% cobasis, a year and a quarter away. Let’s put a checkmark for backwardation extending to farther contracts. We don’t have the data to prove it, but we’d bet an ounce of fine gold against a soggy 10-franc note, that this state of affairs has persisted since 2015 when the Swiss National Bank set the deposit rate negative. So we also put a checkmark for durable. A durable gold backwardation that infects all gold contracts out into the future is what we call Permanent Backwardation.

The cobasis for Dec 2019 is +0.56% cobasis, a year and a quarter away. Let’s put a checkmark for backwardation extending to farther contracts. We don’t have the data to prove it, but we’d bet an ounce of fine gold against a soggy 10-franc note, that this state of affairs has persisted since 2015 when the Swiss National Bank set the deposit rate negative. So we also put a checkmark for durable. A durable gold backwardation that infects all gold contracts out into the future is what we call Permanent Backwardation.

The Collapse of the Swiss Franc

Back in 2015, Keith wrote a paper arguing that the Swiss Franc Will Collapse. A negative interest rate on the long bond is the harbinger of currency collapse. Through arbitrage, everything is connected to everything else. Another sign (and cause) of currency collapse is permanent gold backwardation. As we see here, the negative interest rate is the cause of this backwardation. They are not separate phenomena, but two aspects of the same underlying phenomena. Anyway, whatever the cause, there is now a reluctance of gold owners to give up their gold for francs, and buy futures to get the gold back again. We prove this reluctance by showing that there is a durable opportunity to profit from decarrying gold. That is, to sell gold and simultaneously buy a future. For a maturity of three months, one can get about 1.4% annualized return. And keep the gold—the same amount of gold. And the transaction is risk free, at least as conventionally understood. You can say, “well yeah it’s because there are no opportunities to do anything with the francs for those three months. Anything you would do would have a negative yield, a cost.” And sure, that’s true.

Gold Backwardation

But we must come back to the central thesis of permanent gold backwardation. This reluctance to give up gold on exchange for francs means that gold is withdrawing its bid on the franc. This leaves us to marvel at two things. One, it has endured a long time—going on four years. Two, that savers and businesses in Switzerland do not keep their savings in dollars, exchanging for francs only when they need liquidity (e.g. to pay taxes). We can only assume that the price risk outweighs the small (for now) cost of holding francs. And also, the people around the rest of the world relentlessly buy francs in the belief that it will protect them from their own domestic currency disasters. In other words, the loss to hold francs is smaller than the expected risk-adjusted losses to hold dollars. The gold bid provides a clearer signal, as it is not distorted by the noise of currency risk. The gold holder incurs no currency price exposure. Yet gold holders won’t take the bait of positive cobasis—backwardation—to let go of their gold for three months for a risk-free profit. This profit is only subject to losses from the negative currency yield, and of course risk of losses from default. The gold basis is showing what is not yet shown by the price of the franc. When will “it” happen? We plan to address this question, as we continue to explore the topic of negative yields and positive cobasis in Switzerland next week.

Supply and Demand Fundamentals

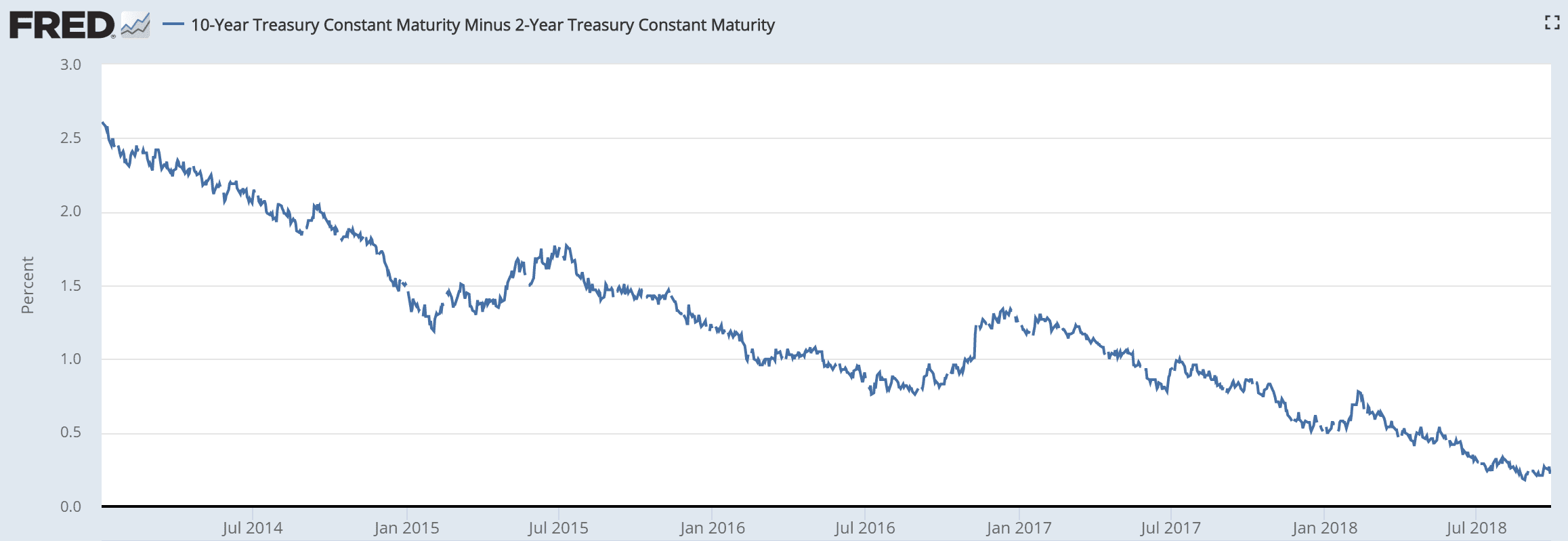

The price of gold fell nine bucks this week. However, the price of silver shot up 33 cents. Our central planners of credit (i.e. the Fed) raised the short-term rate of interest, and threaten to do it again in December. Meanwhile, the stock market continues to act as if investors do not understand the concepts of marginal debtor, zombie corporation, and net present value. People believe that the Fed must fight inflation, hiking rates to prevent overheating. Maybe. What the Fed is, in fact, doing is pushing the yield curve towards inversion. It’s not there yet, but right now the 3-month Treasury yield is 2.22%, while the 10-year yields 3.06%. Here is a graph of the spread between the 2- and 10-year.  Source: St. Louis Federal Reserve In 2014, before the Fed had hinted at hiking rates, the spread was over 250 basis points (i.e. 2.5%). As we recall, the first hints were around July 2015. And the first hike was Dec 2015. By that time, the spread had compressed to half—124bps. Now, it’s down below 1/10, a scant 23bps. Mr. Fed Rate Hike, meet Dr. Falling Interest Trend. He will take care of you, take care of you real good…

Source: St. Louis Federal Reserve In 2014, before the Fed had hinted at hiking rates, the spread was over 250 basis points (i.e. 2.5%). As we recall, the first hints were around July 2015. And the first hike was Dec 2015. By that time, the spread had compressed to half—124bps. Now, it’s down below 1/10, a scant 23bps. Mr. Fed Rate Hike, meet Dr. Falling Interest Trend. He will take care of you, take care of you real good…

Gold and Silver Prices

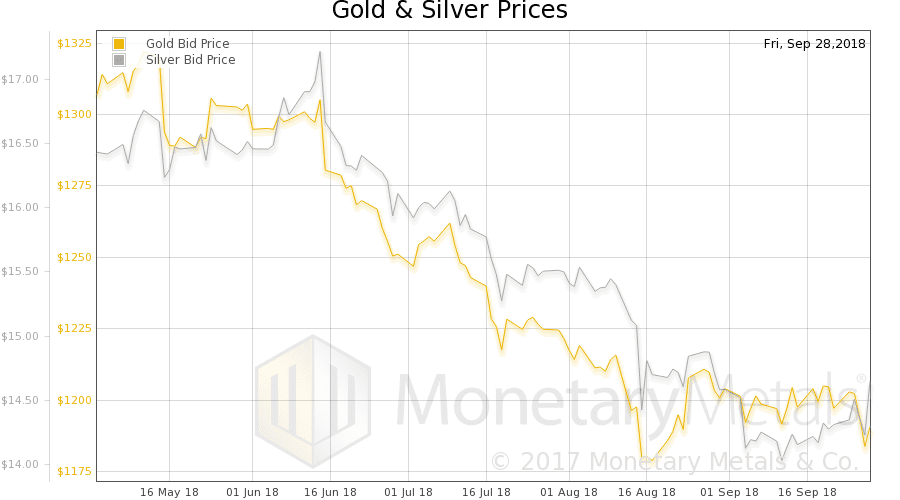

We will look at the supply and demand fundamentals of both metals. But, first, here is the chart of the prices of gold and silver.  Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell dramatically this week. Especially Friday.

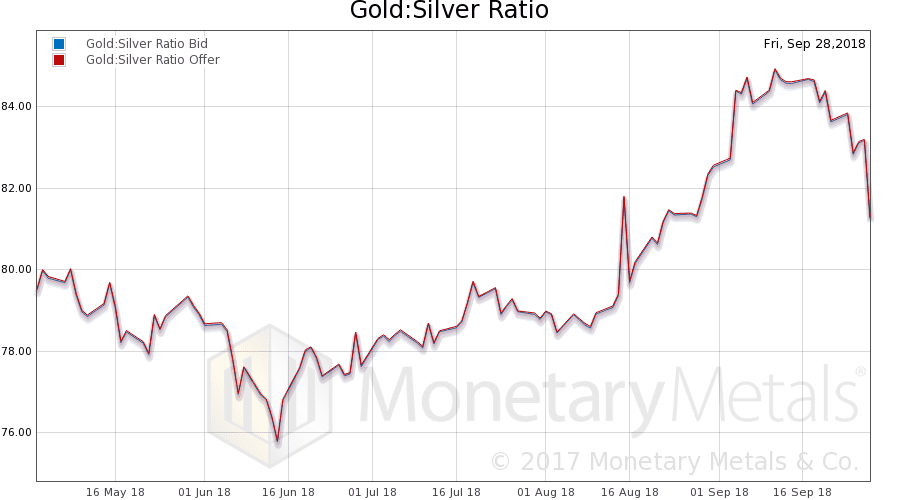

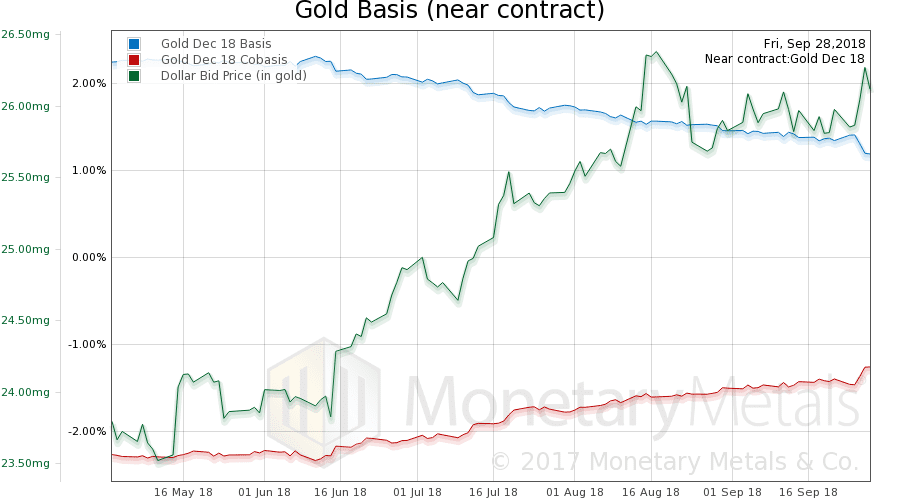

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell dramatically this week. Especially Friday.  Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.  The price of gold is down a bit (shown here as a rise in the dollar, measured in gold), and the scarcity of gold is up a bit. The Monetary Metals Gold Fundamental Price fell $6 to $1,352. But the action was not in gold this week. So let’s look at silver.

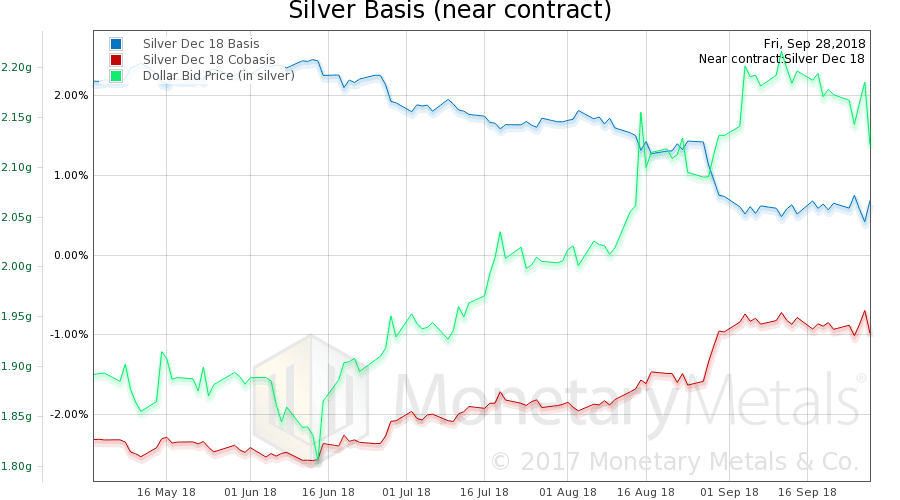

The price of gold is down a bit (shown here as a rise in the dollar, measured in gold), and the scarcity of gold is up a bit. The Monetary Metals Gold Fundamental Price fell $6 to $1,352. But the action was not in gold this week. So let’s look at silver.  In silver, the price rose and the cobasis fell. This is simply the Monetary Metals Silver Fundamental Price fell 11 cents to $15.83. We hear many anecdotes of a pickup of retail silver product sales, but the data so far shows this is mostly a repositioning of speculators—to get the market price closer to where it would be based on the fundamentals. Make sure to subscribe to our YouTube Channel to check out all our Media Appearances, Podcast Episodes and more!

In silver, the price rose and the cobasis fell. This is simply the Monetary Metals Silver Fundamental Price fell 11 cents to $15.83. We hear many anecdotes of a pickup of retail silver product sales, but the data so far shows this is mostly a repositioning of speculators—to get the market price closer to where it would be based on the fundamentals. Make sure to subscribe to our YouTube Channel to check out all our Media Appearances, Podcast Episodes and more!

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:  The New Way to Hold Gold In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

The New Way to Hold Gold In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.  The Case for Gold Yield in Investment Portfolios Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

The Case for Gold Yield in Investment Portfolios Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

:

:

Keith,

Really interesting points you make it would be interesting to do the same comparison as CHF in EUR and YEN also near negative rates also close to backwardation no doubt. Great work love the research.

Fundamental finally cracks. Big surprise.

But who’s even listening?

Hi Keith,

A few of my thoughts on your post:

1) You write ‘Gold is normally a contango market, because the warehouseman is not willing to sell a futures contract without covering the cost of storage’. Suggesting gold should be in contango because to store gold it costs money. However, previous to that you write regarding gold warehousing: ‘Incidentally, this is why all analysis of futures contracts divided by gold in the COMEX warehouses is flawed. It does not count the gold on swap. This gold is in inventory at jewelers, refiners, mints, and other gold-using businesses. It is not in the warehouse, and not counted in eligible or registered inventory’. Additionally, your ideology and business model states people should lend out their gold to earn a yield and for “productive purposes” (stimulate the economy). Isn’t this a contradiction? On one hand you state gold is lend and only a fraction is stored in warehouses, on the other hand you state gold inventories (carried) bring storage costs and therefor gold should be in contango. To me your case why gold should be in contango is not very compelling. If you have another post on why gold should be in contango please share.

2) You write ‘The gold holder incurs no currency price exposure.’ You mean Swiss people that store savings in gold have no risk/exposure to the gold price? This is not true. Swiss goods and services are priced in CHF, and these prices fluctuate less in CHF than in gold. Therefor, any Swiss person holding gold risks this gold goes up and down in value relative to goods and services.