Newly elected Representative Alexandria Ocasio-Cortez recently said that Modern Monetary Theory (MMT) absolutely needed to be “a larger part of our conversation.” Her comment shines a spotlight on MMT. So what is it? According to Wikipedia, it is:

“a macroeconomic theory that describes the currency as a public monopoly and unemployment as the evidence that a currency monopolist is restricting the supply of the financial assets needed to pay taxes and satisfy savings desires.”

It is uncontroversial to say that the Federal Reserve has a monopoly on the dollar. So let’s look at the second proposition. Unemployment, MMT holds, is evidence that the supply of dollars is restricted.

In other words, more money causes more employment!

This does not sound very different from what the New Keynesians say. Keith analyzed former Fed Chair Janet Yellen’s seminal paper on the economics of labor for Forbes:

“Here is their [Yellen and co-author Ackerloff] tenuous chain of logic:

- Disgruntled employees don’t work hard, and may even sabotage machinery.

- So companies must overpay to keep them from slacking.

- Higher pay per worker means fewer workers, because companies have a finite budget.

Yellen concludes—you guessed it:

- inflation provides corporations with more money to hire more people.”

As a footnote, MMT is referred to as neo-Chartalism, and there is some evidence that Keynes was influenced by Chartalism (which goes back to at least 1905).

On Thursday, Marketplace published a piece on MMT. Things are heating up for this hot new (old) idea. Marketplace presented a “bathroom sink” model of the economy (yes, really!)

To wrap your brain around this concept, picture a bathroom sink. Think of the government and its ability to create more money whenever it needs to as the faucet and that bucket area of the sink where the water goes as the economy.

The government controls how much money, or water, is flowing into the economy. It spends money into the economy by building interstates or paying farm subsidies or funding programs.

“And so as those dollars reach the economy, they begin to fill up that bucket, and what you want to do is be very mindful about how full that bucket is getting or you’re going to get an inflation problem,” [Bernie Sanders economic advisor Stephanie] Kelton said.

Inflation is where the sink overflows. If that happens, Kelton said there are two ways to fix it: “You can slow the flow of dollars coming into that bucket. That means the government then has to start slowing it’s [sic] rate of spending, or you can open up the drain and let some of those dollars out of the economy. And that’s what we do when we collect taxes.”

This sounds a lot like the Quantity Theory of Money (QTM). This view often paints a picture of pouring water into a container. The higher the water level, the higher the general price level.

QTM by itself does not promote the idea that more money causes more employment. Only that more money causes more rising prices. But Keynes did. And the New Keynesians like Yellen do.

So what makes MMT unique?

According to Stephanie Kelton, in the Marketplace article:

“If you control your own currency and you have bills that are coming due, it means you can always afford to pay the bills on time,” Kelton said. “You can never go broke, you can never be forced into bankruptcy. You’re nothing like a household.”

Keynes taught us about government deficits to bolster employment and government deficits to respond to a crisis. MMT teaches us how to get to the next level. The voters want free goodies. Traditional economics says “there ain’t no such thing as a free lunch.”

MMT says “oh yes there is!”

At least until you get to too much inflation. The Monetarists would agree, don’t print too much money or you get too much inflation. Much of the gold community also agrees. If you print too much money, then you get skyrocketing inflation.

Never mind that this prediction was proven wrong in the post-2008 policy response. We want to highlight that the Keyesians, the Monetarists, the MMTers, and even many Austrians largely agree. The problem with too much money printing is too much inflation. They quibble about what is too much, but they agree on the “bathroom sink” model of the economy.

In the words of early 20th century physicist Wolfgang Pauli, QTM “is not even wrong.”

We define inflation as the counterfeiting of credit. That is, fraudulently taking money from a saver. It is called borrowing, but the borrower hasn’t got the means or intent to repay. Additionally, when everyone thinks that the government’s debt paper is money, the saver doesn’t even know or consent to the borrowing.

There are lies, damnlies, and statistics. Then there are a few pugnacious, in your face, gaslighting make-you-believe-in-unreality cargo cults. We will explore this in full, below.

During World War II, the US military set up operations on certain Pacific islands. They built landing strips, where they landed planes bringing in supplies and men. They hired the local tribesmen as labor, and paid them stuff that was ordinary to Americans, but wondrous to the islanders. Like canned food. The islanders really looked forward to when a plane would land, and they would get some cargo.

After the war, the US military pulled up stakes and left. But the islanders still wanted the cargos. So they set up these elaborate charades, with tiki torches instead of flashlights, and coconut shell mockup headphones. They went through the motions that they thought the Americans did. To try to bring back the cargos.

Huh. What does that remind you of? An elaborate charade, with bogus props, going through the motions of a civilization they don’t understand to try to produce desired results—free goodies?

Modern Monetary Theory is a cargo cult.

It’s ironic that the name includes the word modern. If we said that a pile of greasy rags sealed in a dark closet would spontaneously generate rats, would you call that a modern theory? If we said that sickness is caused by bad humors, and the cure is bloodletting by leaches, would you say this is modern? How about the idea that the Sun and the planets orbit the Earth. Is this modern, too?

Not only are these not modern—they are, in fact, old ideas that were tossed into the garbage heap—they are not theories either. A theory is an explanation of reality, which integrates many observed facts and contradicts none. Modern Monetary Theory is neither modern nor a theory.

MMT is not an attempt to explain reality, but to deny it.

Even a child understands something. Even people in the ancient world understood it, too. If you lend a bushel of wheat to your neighbor, and he does not repay it, you suffer a loss. You are worse off, compared to before. And so is the borrower (who at the least ruins his credit).

MMT is based on denying this universal truth. Common sense says that if Peter lends to Paul, and Paul does not repay, then Peter is impoverished. Common sense says that Peter would not lend to Paul if he knew that Paul would renege on his obligation.

MMT says that a modern economy has a modern currency, which is just the state’s paper. And in a modern economy, the modern state can print more with no concerns other than “overflowing the bathroom sink”. Get that, the only concern is prices could rise too fast. And so long as this does not occur, then the state can get away with it. Only, there is nothing to get away with. It’s perfectly fine.

In a cargo cult, the people did not recognize the difference between fake coconut shell headphones, and real headphones. Or flashlights and tiki torches. So they made crude copies as best they could. They went through the motions to summon the sky gods to come down to earth, with cargo.

Let’s look at the mental gymnastics. They imbued magical—that is outside the principle of cause and effect—characteristics to their props. Failing to understand that airplanes are created by men, and that it takes a great deal of planning (not to mention wealth) to fly a plane full of cargo from America to the middle of the Pacific, they imagined that, somehow, the act of using the headphones and the flashlights caused the plane and its cargo to come. The headset is tokenized, viewed as a magical talisman.

What a cargo cult does to headphones, MMT does to money. First, the cargo cult substitutes coconut shells held together with twisted vine for headphones. What they wear when attempting to summon the sky gods is not a headset, but a surrogate. MMT (as does Keynesianism and Monetarism) substitutes government debt paper for money.

As an aside, even a gold-redeemable certificate is not money. Think about it. You can bring this piece of paper to the teller window. You push it across the counter. The teller pushes back the gold coin. If the word for the paper is money, then what is the word for the gold for which it redeems?

Anyways, modern monetary systems use irredeemable paper. It’s not gold-redeemable, but even worse. And they treat this paper as if it were money.

And it goes even farther. Previous theories felt the need to at least pay lip service to repaying debt. They couldn’t quite get to the point of openly admitting that the debt is never to be repaid. Keynes famously quipped that, “in the long run, we are all dead,” creating ambiguity about the intention to repay. Monetarists generally promote the idea that if the economy grows fast enough, the debt will shrink as a proportion of GDP.

The Keynesians don’t have the intention to repay. And the Monetarists don’t look at Marginal Productivity of Debt, which would show them that their idea isn’t working. But they don’t go as far as the MMT’ers.

MMT says that the government is unlike deadbeat-debtor Paul. There is no need for the government to repay. It’s the same as the cargo cult. The cargo cult has no concept for capital. The islanders do not produce in excess of what they consume, accumulating tools and technology to increase their productivity. They subsist, and assume that this is how the world works.

MMT has no concept for capital either. It puts blinders on, declaring that consumer prices are the only thing to measure. The only risk is if they rise too fast. And the MMT’ers refuse to see anything else.

In our discussion of Yield Purchasing Power, we introduced a farmer who sells off the back 40 (acres), chops down the apple orchard to sell the fruitwood, tears down the old barn to sell the planks, and even dismantles the tractor. And why does he do this? He gets cash in exchange. And the cash is far in excess of his crop yield. Why struggle and sweat to produce $20,000 a year by growing food, when you can sell off the piece of the farm for $20,000,000.

The monetary system incentivizes the farmer to trade productive capital for paper credit slips. The incentive is that this paper has a greater purchasing power than what he can earn by operating the farm. He can trade his farm for far more groceries, than the food he could grow on it.

This is the same old game. But MMT gives it a new name—and asserts a bolder defense. MMT’ers don’t want to see, and they want you not to see, that the lender gives up good capital but the borrower is just consuming it.

MMT justifies the naked consumption of capital.

Supply and Demand Fundamentals

The prices of the metals rose this week, especially on Friday. The exchange rate of gold went up twenty two US dollars, and that of silver 41 US cents.

As we will discuss below, we think that there is a rethinking of gold occurring in the market. And we don’t just mean celebrities like Sam Zell buying gold for the first time.

There is a sense of déjà vu. Starting in mid-2004, the Fed went on one of its rate-hiking sprees. It did not manage to get as high as the previous peak of 6.5%, set prior to the previous crisis. In 2006, this rate topped out at 5.25%. In both the crisis of 2001, and the crisis of 2008, the Fed had begun cutting rates before the official indication of recession, and the cuts occurred more rapidly than the preceding hikes.

The cuts were too little and/or too late to avert disaster.

The problem is that during the period of low rates, firms are incentivized to borrow. They finance projects which generate a low rate of return. These projects would not be financed, but for the even-lower cost of borrowing. When rates rise, it does not increase the rate of return produced by marginal projects (likely the opposite). So borrowers are squeezed.

The Fed eventually comes along with its fix—even lower rates. While this is too late to save firms that are teetering into default, it does enable the next wave of borrowing for even-poorer-projects.

And now, here we are. Since its first tepid hike in December 2005, the Fed has been hiking for just over three years so far. It has hit a rate well under half of the peak of 2006-2007. The president has publicly urged the Fed to reverse policy course. And the Fed said it is listening to the market, and may have paused hiking for now.

Meanwhile, the Fed Funds rate may be lower than the previous peak but it is much higher than it was from the end of 2008 through the end of 2015. For seven years, it was basically zero. Nobody knows how many dollars’ worth of projects were financed that were only justified, only possible, due to this zero interest-rate policy. But it was surely a lot (we would guess at least trillions).

And now the rate is up to 2.25%. Many of those projects are no longer justified, and can no longer service the debt that finances them.

And none of this is a secret. It is well known to the borrowers, of course. And their creditors. And the Fed. And hedge funds and other sophisticated speculators. And not just in general theory, but lists of specific companies and the rollover dates of their bond issues.

Rollover is key to this. After decades of falling interest, everyone has learned the game of using short-term financing. But the risk is that it must be rolled over. And when it is rolled, the previous low-rate is replaced with the higher, current rate. And that’s when we find out which businesses can still pay.

So what will the Fed do? The next programs will have a new name, but the Fed must lower the cost of capital if it wants to keep the game going.

Is this time going to be the total collapse of the dollar? We don’t believe so, as there is still a lot of capital remaining and more is flooding in as people abandon the dollar-derivative currencies. So we think of it as déjà vu, the Fed is likely to do something similar to last time.

And that is an environment where even the non-goldbugs see clear and compelling arguments for owning gold.

It could be that the timing is not now. It could be that it will take months or years to arrive at this point. We make no predictions of timing. However, we note that the Monetary Metals Gold Fundamental Price has been in a rising trend since mid-October. Its low was on October 9 ($1,266).

Silver is similar, but a bit different. The low in its fundamental occurred in late November ($14.37). But it’s up like a rocket since then, now about two bucks higher.

We are at an interesting point.

Let’s take a look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver.

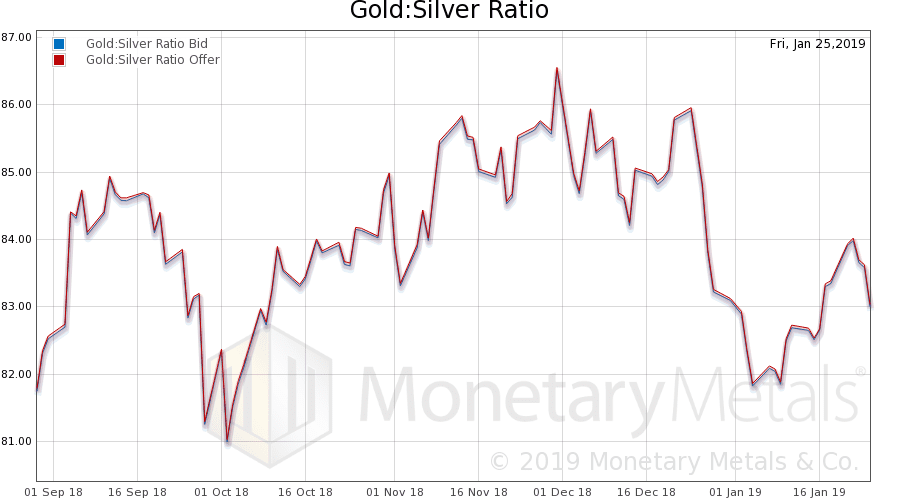

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It fell almost a point this week.

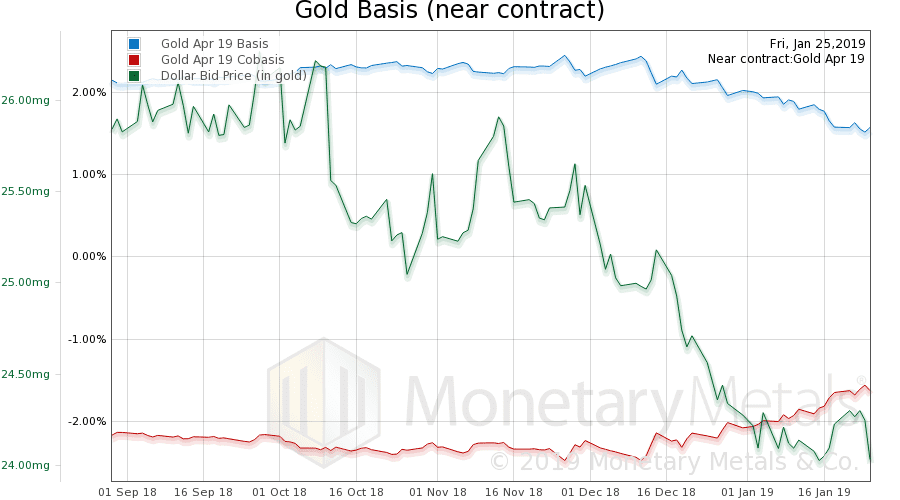

Here is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price.

The rise in the cobasis (i.e. scarcity) continues. This is notable, in the face of rising price of gold (inverse to the drop in the price of the dollar shown here).

The Monetary Metals Gold Fundamental Price rose $16 to $1,350.

Now let’s look at silver.

Similarly, silver became scarcer as its price went up. Its price went up even more than gold’s did.

Unsurprisingly, the Monetary Metals Silver Fundamental Price went up 34 cents to $16.34.

© 2019 Monetary Metals

:

:

Hi Keith. Great article. The cargo cult analogy is perfect!

How come you also track and report on the Gold:Silver ratio? I don’t really see how it relates to the rest of your thesis/analysis.

Another excellent article Keith, thank you.

The cobasis is rising a little, indicating growing physical buying, but the difference between the fundamental and market price isn’t changing much. Does that suggest that physical buying is a bit weaker than that indicated by the cobasis?

Brian: the gold:silver ratio and the ratio of their basises can potentially indicate arbitrage opportunities between the two metals. Both are considered monetary metals, owing to their high stock/flow ratios – but they also have slightly different factors of influence.

Hi Keith,

Thanks for once again pointing out the rotten QTM foundation of nearly all monetary policy thinking. I suppose you’re right that this is also a feature of MMT; it is certainly where the MMTers eventually land once they assume policy-making stature. Their idea that policy that acts on the supply of money can achieve societal good is just wrong. Like much statism it is founded on the magical thought that the planner is some kind of benevolent demi-god whose actions do not drain resources to achieve personal ends like all of us mortal sinners. If communism believed that the state would evolve a saintly “socialist man”, central planning of all sorts assumes he exists already. And monetary central planners think he holds super-powers able to create liquidity.

All of the above might be attacked as “modern” monetary heresies.

But I want to carefully and for very limited effect defend one of MMT’s foundational claims…

As I think I’ve said here before, liquidity emerges as a result of “certainty” (i.e. low information-theoretic entropy).

Money is the most liquid commodity (gold); That is due to mankind’s certainty about natural law and a collection of well-observed (objective) facts about the earth’s resources. We also see even-more-liquid derivatives (paper golds of various kinds) are possible money substitutes when the rule of (human) law is certain enough for contracts to be widely trusted. Moneyness is an emergent property of low-entropy systems.

There are two other famous “human” certainties, death and taxes. I believe the first leads us (in a roundabout argument) to the Real Bills doctrine–not death itself so much as Life and specifically the survival of a society through thick and thin and across the ever-dying generations. The idea that societies keep themselves going through trade and the division of labor lies at the root of our certainty that we can (with care) grant credit to the commerce that enables basic survival. With Adam Smith, and the Banking School, and the New Austrians, we become willing to monetize social circulation credit.

Now to taxes–the certainty about these came later and more reluctantly. The deep theorists of MMT, however cite decent historical evidence that taxation done to support very widely shared collectivist projects can take the form of very secure credit, liquid enough to be monetized. I think that limited aspect of their claim is correct. I believe there are (potentially) many fonts of entropy in human life, a few of which might be monetized under the right conditions.

It is a mistake to insist that only one source of liquidity exists or is worth monetizing. Any school (from 100% reserve banking, to modern Federal Reservists) that tries to elevate one to dogma and ignore the others is incomplete and will finally be found too inefficient when confronted with an organic mixed-strategy that seeks out true certainties and objective truths the way real humans do it.

Does this diminish gold’s role? Hardly!