On this page you’ll find answers to the questions we get asked most often, including:

How can I earn a yield on gold and silver?

How does Monetary Metals work?

How does leasing gold and silver work?

How can I open an account with Monetary Metals?

How can I earn a yield on gold and silver?

If you’re short on time or simply prefer to watch instead of read, check out our video on how to earn a return on your gold and/or silver.

It’s actually quite simple.

The way we deliver a yield on gold is by financing productive businesses that either need gold as inventory (gold leases) or as capital to expand production (gold bonds).

How does Monetary Metals work?

How is Monetary Metals able to pay a yield on gold and silver?

We pay a yield on gold and silver by connecting our clients with businesses that use gold productively as part of their inventory or work-in-progress. This includes jewelers, mints, precious metals dealers, refiners, recyclers, and mining companies.

We provide qualified businesses with Gold Financing, Simplified™. They happily pay a fee to lease or borrow the gold & silver they require in their business. We take a small percentage of what they pay and the rest is distributed to our clients.

How does Monetary Metals make money?

Monetary Metals makes money by making a market between owners of gold and silver and businesses that have a financing need in gold and silver. Revenue is earned by covering an interest rate spread on each financing transaction, whether a lease or bond.

This spread comes from the interest rate on the transaction. For example, let’s say Monetary Metals brings “Acme Lease A” to its clients. Acme is paying 5.5% to lease gold from Monetary Metals, and clients in the lease are earning 3% on their gold in the lease. The 2.5% difference is what Monetary Metals earns in revenue for bringing the lease to its marketplace.

What yield can I expect to earn?

Historically, Monetary Metals’ leases have paid between 2% – 5% net annually to investors. The weighted average rate of return in our lease program currently hovers between 3% and 4% and is regularly updated on our website. This rate of return is denominated in ounces and paid in ounces. For example, 100oz earning 3% every year, will generate 3oz in gold income, annually.

Gold bonds, which are securities, offer higher yields, from 6% to 19% on our recent offering. Gold bonds are available to accredited investors only.

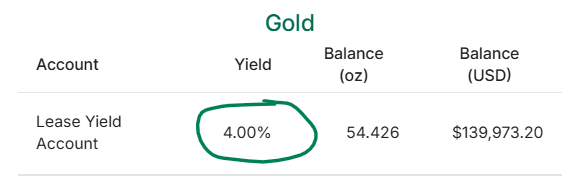

You also earn yield on the gold in your Lease Yield Account before it goes into leases. The rate you can earn on this gold is published in your client portal, and is subject to change.

The amount you earn at this rate is based on how much gold you have in your Lease Yield Account and the number of leases you opt into. If you opt in to 100% of all available leases on our platform, you will earn 100% of the published Lease Yield rate. However if you opt into only 50% of available leases, then you will earn only 50% of the rate (i.e. 2% instead of 4%).

Once your gold goes into a lease it will stop earning the Lease Yield Account rate and will start earning at the rate that corresponds to each specific lease.

Does Monetary Metals also pay a yield on silver?

Yes. We offer silver leases and bonds in addition to gold leases and bonds. Clients can open an account, deploy their their silver, and earn yields in silver. Silver in your Lease Yield Account does not earn a yield.

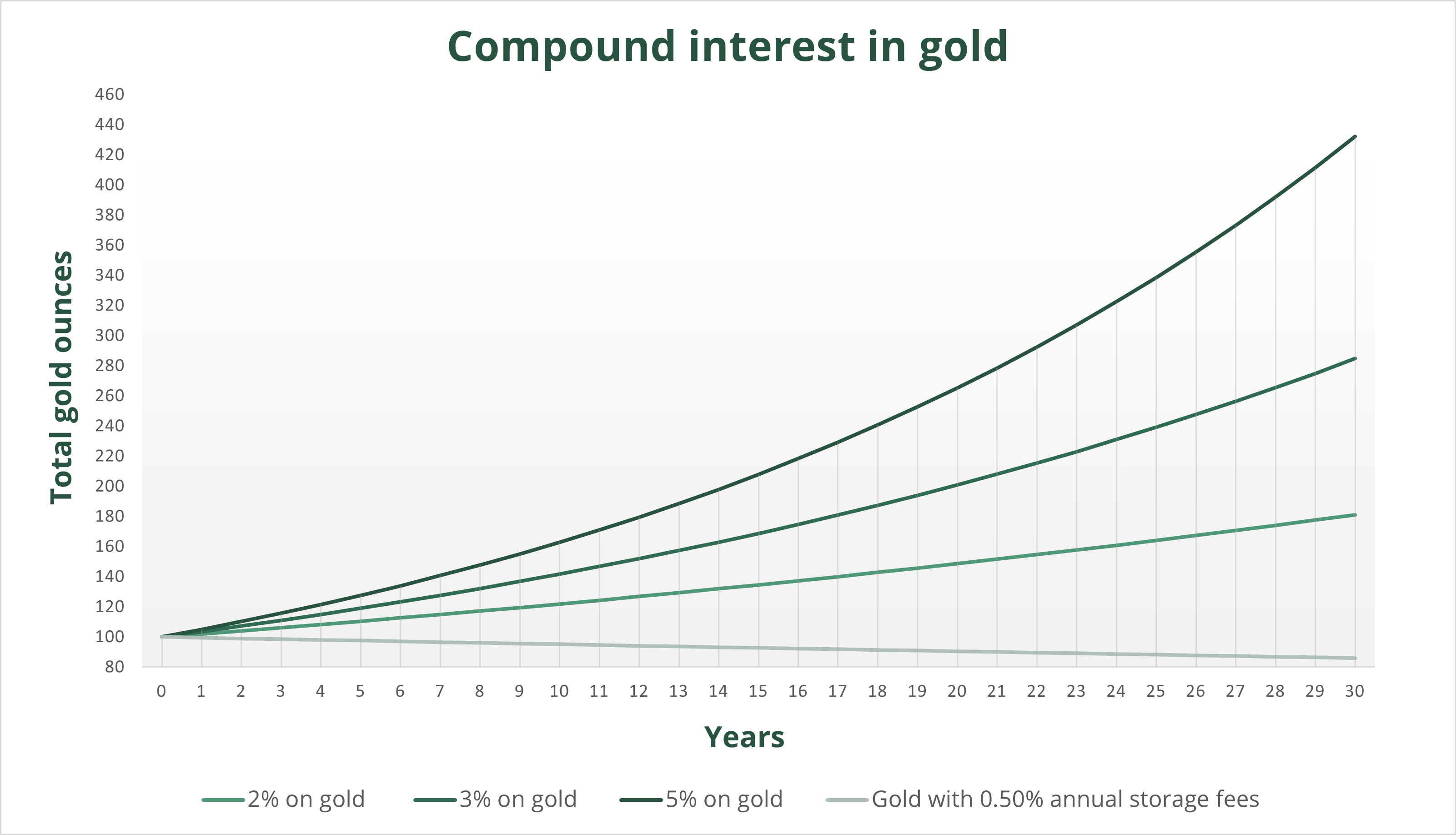

Does Monetary Metals offer compound interest?

Yes! The power of compounding interest comes from redeploying or reinvesting the yield earned. With Monetary Metals you can harness the power of compound interest with ounces of physical gold and silver. When you earn yields in our leases and bonds, you can reinvest that yield in other leases or bonds, enabling you to compound your total gold and silver holdings.

When and how are the yields paid?

Most of our leases pay yields monthly, but some pay quarterly. Bond payments vary with the specific offering. Payment frequency is disclosed to clients before committing to an opportunity.

Generally, yields are paid in kind (silver yields for silver leases, gold yields for gold leases) and is deposited directly into the client’s account.

Clients can easily see the total amount of income in ounces they have earned in their client portal or on their monthly statements.

ZERO fees for storage and insurance?

Yes.

We do not charge any storage or insurance fees.

There is a cost to store and insure precious metals. But Monetary Metals is in the business of Unlocking the Productivity of Gold™ so we have a different business model than merely collecting fees on stored metals.

We make money by putting metal to work so our clients can earn more metal. In other words, we only make money when you make money. This creates a healthier alignment of incentives between company and client.

By providing complimentary storage and insurance on any undeployed metal, we are incentivized to bring attractive opportunities for our clients to earn a yield on gold and silver and grow their total holdings.

Why is it so cost-effective to buy and sell gold with Monetary Metals?

Our aim is to get clients the most gold possible so they can put more of their ounces to work. High premiums mean less gold that can be put to work in gold leases or gold bonds. Monetary Metals sells and buys gold (and silver) at a spread to the London Fix price, or the spot price, depending on when the trade occurs. Below is a table of our spreads according to the volume of the transaction.

| Tier | Spread |

| Under $250k | 0.75% |

| $250k – $1 million | 0.55% |

| $1 million or more | 0.40% |